Option Spotlight: Option Strangle on your favorite WEED stock?

Now that the markets moved back up a bit and we can all breathe a little (knock on wood), let’s bring our attention back to the historical event, if only for a moment Oct 17 2018.

Yup, LEGALIZATION OF RECREATIONAL WEED BEGINS IN CANADA.

So as an investor, of course we’re all thinking, history is being made here, I mean once in a lifetime shift in culture type thing, and how can we profit from this? We had several suggestions from the Meetup crew that suggested various pot stocks recently, from PBY to ACB to CGC.

And like every good Greek Mythology story, what’s coming over the next few months will be epic; some companies are going to soar, and some will die or be bought out. But alas, what will happen to who?

Here is where an option strategy known as the option strangle might be useful.

This is where you would buy a call option slightly out of the money, and a slightly out-of-the-money put option on the same stock. Let’s take Canopy as an example as it’s currently the biggest horse at the county fair. Let’s say you expect Canopy to either soar skyward or plunge straight down a cliff and think either will happen before mid-January.

Using Oct 12 2018 information:

CGC trading at approx. $50

Get a a JAN 19 2018 CALL option strike 60 (about $500)

Get a JAN 19 2018 PUT option strike 40 (about $360)

Thus pinning in that range 40 to 60. This option strangle would cost about $860 total and note that you would be expecting one of these options to be a total miss.

But I think most of us would agree, that up or down, the share price movement of many of these stocks, including Canopy is going to be dramatic (be it new deals announced or earnings). So if Canopy were to move by $20 in either direction in the not too distant future, you would stand to profit.

See Chart here: https://yhoo.it/2IUzQLc

(Note the months and strikes I choose was done at first glance, just want to keep this example simple and demonstrate the strategy).

A final note: option strangles ought be used wisely! You must believe that the stock you’re looking at will be having an epic move up or down within the timeframe you’re thinking, enough to offset the call or put option that will be losing value.

Option Spotlight: Canopy Growth Corporation CALL OPTIONS

Hi Everyone, we'll be having another online meet up soon. Details to Follow!

As every Canadian must be aware by now, the use of marijuana for recreational purposes will soon become legal (as opposed to just medicinal use). Whether or not you agree with this, it presents some very very interesting investment opportunities. Rest assured, history is being made and tectonic shifts are going to occur as a result in this area.

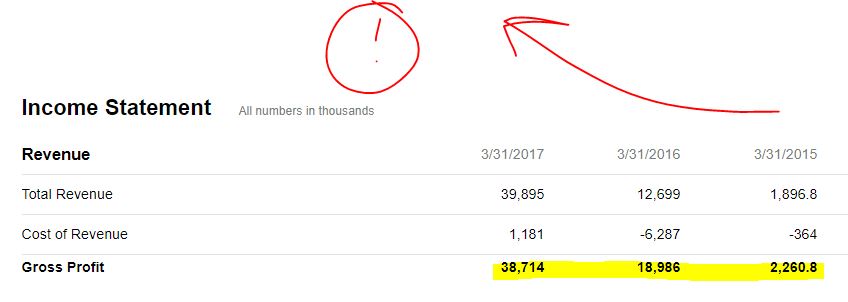

One of the company's best poised to capitalize on this is Canopy Growth Corporation. The government absolutely intends to be the Distributing Authority on weed, however it is not in the business of growing it, and while they are a few players that can supply, none of them at this point hold a candle to Canopy Growth Corporation.

In fact, it's long trajectory from 1st corporate start-up cannabis producer to first global cannabis unicorn is now complete, with the listing on the New York Stock Exchange under symbol “CGCâ€.

A smart way to play on this possible trend would be to look at CALL OPTIONS ON Canopy Growth Corporation (CGC).

Understandably, the call option are a bit expensive for the stock; fortunately users of OptionDistrict.com can split an expensive option in two parts and still invest in Canopy using small amounts of money, with nothing else at risk. Joining this investment community is fast and simple. See here: https://optiondistrict.com/why_choose_oa.php for a few advantages of joining!

Back to canopy--for one thing the world’s largest trading pools – pension funds, sovereign wealth funds, blue-chip ETF’s. etc. – can now buy the shares of Canopy after its recent listing on the NYSE. That alone could cause the share price of Canopy rise continuously throughout the year ahead.

The full adoption and implementation of Bill-C45 in Canada, which will make Canada the world’s first G7 nation with full recreational and medical regulations on a national scale, is also poised to further legitimize cannabis companies in the eyes of the world.

Canopy is already the most valuable marijuana company on earth. With a full listing on the world’s most valuable stock exchange, that value is poised to test new highs.

See information here: https://finance.yahoo.com/quote/cgc/?p=cgc

As always when investing with options in this way, always give yourself enough time to be right!

Remember that you can join those of us who are already investing on OptionDistrict.com, an online investment community, to see what other members are thinking or to participate by splitting expensive options into units and so invest with others to dramatically reduce your risk and money needed. Get into Netflix, Intel, Oil or CGC for as low as $100. New sectors and opportunities are always being listed. Any questions, drop me a line!

Option Spotlight: Options Spotlight: Netflix Call or Put options

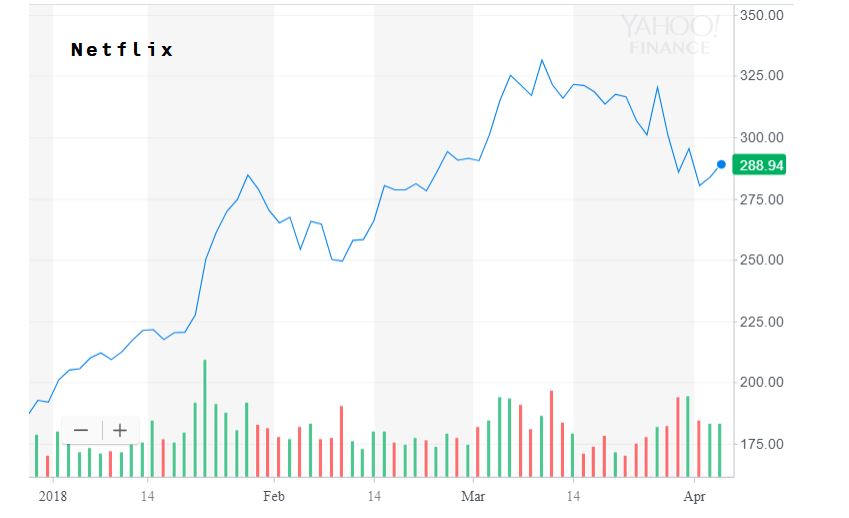

Was there ever a stock in recent times as a wild and unpredictable as Netflix (NFLX)? Take a look at the price chart over the last year and you will see swings that can only be described as untameable.

Though the price has mostly been headed up, price swings of 10, 20, 30% or higher in a month up and then down again is actually not uncommon.

In general, part of what determines the price you pay for an option is the volatility of the underlying security. The wilder and more unpredictable the stock behavior, the more expensive buying a put or a call option on it will be. As a result, a put or call option on Netflix is expensive, even one that expires in just a few weeks. That being said, if you look at the stock price behavior you will see that if you get the direction right HUGE profits are there to be made if you have the stomach and the capital...

A great site for looking at the recent price history of an option you are considering buying is Marketwatch.com; they have option price history for any option you might consider, and it's a free site.

Note that a good way to invest in an expensive option on Netflix would be to split the cost as is typically done on OptionDistrict.com

Here members can participate in option Investments by splitting the total cost in two or more parts and allowing other members to invest with them there by splitting the overall cost and risk. As a result you can invest in Netflix, where an option might cost you $1,000 or more, for for just 100-$200!

Option Spotlight: Option Spotlight: USO and BOIL OPTIONS

Hi, hope everyone's doing well!

Just wanted to quickly discuss and possibly introduce you to two ETF's which allow us to play the energy markets and also happen to have options traded on them;(ETF stands for "exchange traded fund", which for our purposes behave just like stocks).

Two great reasons for investing in energy plays would be:

i. Energy use and prices are without a question, cyclical, making longterm plays more predictable

ii. Energy prices follow a bit more fundamental cause and effect narrative than what might gleaned from the balance sheet or income statement for a corporate stock. Harder to fake the numbers in the former case!

The first one which many of you may already know is USO. USO seeks to achieve its investment objective by investing primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels.

The second one is the lesser known BOIL. This ETF seeks results for a single day that match (before fees and expenses) two times (2x) the daily performance of the Bloomberg Natural Gas SubindexSM.

If you were bullish on either of these energy markets a call option might come under consideration.

A point of note: Both of the do not perfectly track the energy Market they are based on, but since we are at the low end of a price cycle for oil and natural gas, and long-term call options on both of these appear to be quite cheap, it is a fairly inexpensive way to speculate in the energy markets.

As always when investing with options in this way, always give yourself enough time to be right!

Remember that you can join those of us who are already investing on OptionDistrict.com, an online investment community, to see what other members are thinking or to participate by splitting expensive options into units and so invest with others to dramatically reduce your risk and money needed. Get into Netflix, Intel, Oil or Bank options for as low as $100. New sectors and opportunities are always being listed. Any questions, please drop a line!

Option Spotlight: Option Spotlight: SPY OPTIONS

Hi Everyone, once in awhile I will send out an area where option investing might be useful, and also explain why so.

Well the last few days has certainly been a bit tumultuous in the market!

Dow 25,520.96 -665.75 -2.54%

S&P 500 2,762.13 -59.85 -2.12%

Nasdaq 7,240.95 -144.92 -1.96%

So what would you do if you don't have a clear stock to invest in right now, but had strong feelings about the overall direction of the stock market over the next few months?

Option Spotlight: SPY OPTIONS

SPY [SPDR S&P 500 ETF Trust] is a trust that trades as a stock, and generally corresponds to the price and yield performance of the component common stocks of the S&P 500 Index.

So by investing in this you would, generally speaking, be investing in the general direction of the US stock market.

In brief, if you thought the market would recover and keep climbing you would get a SPY call option, if you thought the market was be getting a decline (I personally would wait another week or two to be sure) you would get a SPY put option.

Not sure how a put or call option works or how you might option invest as described above? Come to one of our meet ups and learn the ropes!

Note that our Investment Group at optiondistrict.com allows us to pool together very small amounts to enter various option investments together, thus getting into the action while significantly limiting the risk.